Payroll Management System

| Document Title | Payroll Management Guide |

|---|---|

| Document Number | PMSG -002 |

| Version | 2.1.25 |

| Author(s) | Assistant Manager, Payroll |

| Reviewed By | Senior Analyst, Payroll |

| Approved by | Senior Manager, Operations |

| Last Update Date | April 11, 2025 |

About the Module

Payroll: Payroll is the comprehensive management of all financial records related to employee compensation, including salaries, bonuses and deductions. From an accounting perspective, payroll refers to the payments made to employees for their services over a defined time period.

The Payroll Management System further streamlines this process by handling the following key functionalities:

- Salary Calculation and Disbursement: Manages employee salaries, including allowances, deductions and bonuses.

- Report Generation: Automates the creation of monthly salary statements and other payroll-related reports.

- Employee Self-Service: Provides employees access to their personal information and payroll details, ensuring transparency and control.

Key Features of the Payroll Management Module

- Comprehensive Salary Processing: Facilitates salary calculation in alignment with updated pay commissions.

- Budget Management: Covers budget allocation to disbursement for effective fiscal planning.

- Automation and Efficiency: Processes salaries for various employee categories such as:

- Permanent Staff

- Contractual Employees

- Ad-hoc and Guest Faculty etc.

- Attendance-Linked Salary: Automatically calculates salaries based on working days.

The payroll module is a powerful tool designed to meet the financial and fiscal needs of Universities and Higher Education Institutions (HEIs), ensuring smooth and efficient payroll operations.

Additional Features of the Payroll Module

The Payroll Module is equipped with advanced features to cater to the complex needs of employee payroll management in Universities and HEIs:

- Online Tax Declaration & Calculation

- Facilitates employees in declaring their taxes online.

- Automates tax calculations based on the latest tax slabs and deductions.

- Other Taxable Payments

- Handles additional taxable components such as perks and allowances.

- GPF (General Provident Fund) Calculation

- Automatically calculates GPF contributions for eligible employees.

- Pension & Gratuity Calculation

- Manages post-retirement benefits like pensions and gratuities efficiently.

- Increment Generation

- Automates the process of incrementing salaries based on pre-defined criteria.

- Advances/Loan Calculation

- Tracks and calculates employee advances or loans and their repayments.

- Recovery

- Manages recoveries for loans, advances or any other dues.

- Arrears Process

- Processes arrears for revised salaries, allowances, or other adjustments.

- Salary Bills & Deductions Parking

- Generates salary bills and manages parking for deductions.

- Pay Fixation

- Simplifies pay fixation during promotions, transfers, or other revisions.

- Pay Slips & Paybill Generation

- Generates detailed pay slips and consolidated pay bills for employees.

- Comprehensive Reports

- Provides detailed reports on payroll, taxes, deductions, arrears, and more, ensuring transparency and compliance.

These features enhance the efficiency of payroll processing while ensuring compliance with institutional and governmental regulations.

Prerequisites to Initiate the Payroll Management System

To effectively use the Payroll Management System, Universities/HEIs need to complete the following configurations in their Samarth Suite:

- Configuration of the Base Module with Organizational Unit Types

- Define and set up the organizational structure, including all unit types (e.g., departments, sections, centres).

- Addition of Employee Details in Organizational Units

- Ensure all employee records (permanent, contractual, ad-hoc, guest faculty) are added under the respective organizational units.

- Creation of Administrative and User Accounts

- Create administrative accounts for module administrators.

- Set up user accounts for employees to ensure access and functionality.

Note:

- These configurations must be completed by HR administrators or users assigned the admin role for the respective modules in the Samarth Suite.

- Accurate and complete data entry is crucial to ensure smooth payroll processing.

Roles in the Payroll Process

There are 6 types of User roles available in the Payroll Management Module.

payroll_admin (Payroll Admin) The role to be given to the administrative account can configure all the settings of the payroll module, the Admin can generate & approve salaries, and they can change the salary heads and fetch all payroll reports.

payroll_pcm (Payroll Change Manager) The role is to be given to the administrative account responsible for bulk updating the salary heads of the employees.

payroll_pda (Payroll Dealing Assistant) The role is to be given to the administrative account responsible for generating the salary.

payroll_pvo (Payroll Verifing Officer) The role is to be given to the administrative account responsible for verifying the salary.

payroll_pfo (Payroll Finalizing Officer) The role is to be given to the administrative account responsible for finalizing the salary.

payroll_ar_salary (Payroll Approving Officer) The role is to be given to the administrative account responsible for Approving the salary.

Note: Employees can download payslips and declare Income Tax forms through their User login. These roles are automatically configured when the administrator creates the employee login.

Administrator’s Guide (Payroll_admin)

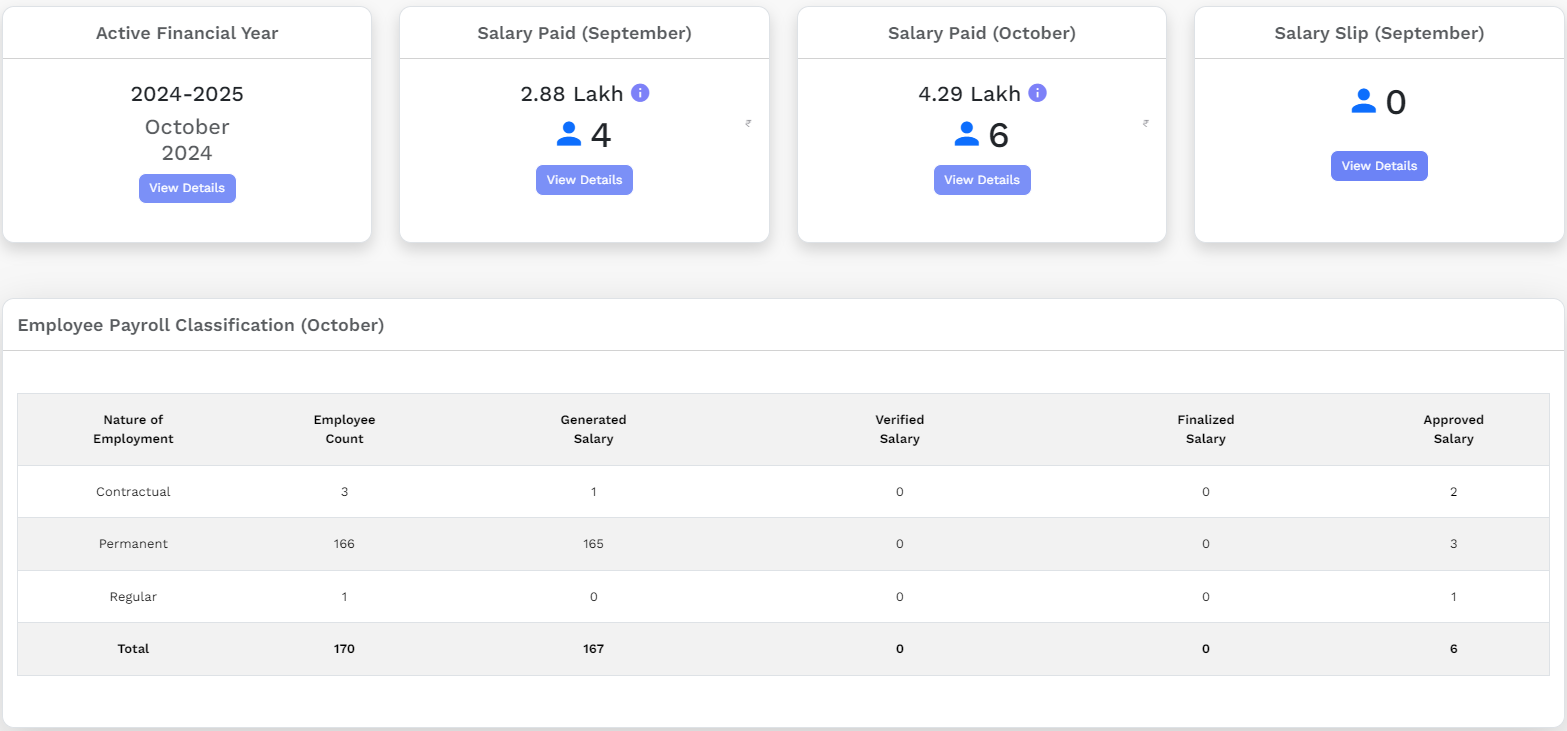

Payroll Management Dashboard

The dashboard gives an overview of the Payroll Management for all the employees working in the University/Organisation Unit.

Key Dashboard Features Include:

- Active Financial Year: Displays the salary status for the current year and month.

- Salary Paid (Previous month): Shows the total count of employees and the paid amount for the previous month.

- Salary Paid (Current Month): Highlights the approved employee count and paid amount for the current month.

- Salary slips: Lists employees who have downloaded their payslips in the previous month of user login.

Configuration (Settings)

To start the Payroll process, the admin is required to configure the payroll settings. This can only be done by the admin.

Bank Lists

Admin - (with the user role payroll_admin) can view bank details here. This section also displays the detailed list of banks which will be mapped with the employees.

Pay Commission

This section displays a list of various Pay Commissions active in Universities/HEIs.

- The Pay Commissions section displays the following:

- 6th Pay Commission

- 7th Pay Commission

- Not Applicable (Not Applicable for only Contractual Employees)

Financial Cycle

A financial cycle is used by the University in order to calculate its budget for a period of 12 months.

- Click on the Add Financial Cycle button provided on the top right-hand side

- Admin can update and view previously used cycle details

Some new fields were added in the Financial Cycle Setting in the settings section.

No. of Increments:

Universities can add the total number of increments in a Financial Year in this field. This is entirely dependent upon the Universities/HEI whether they want to give increments once, twice, or thrice to their employees in that Financial Year.

Increment Interval:

This field defines the duration between two increments in terms of months. Universities/HEIs should add this field for the date of the next increment for each employee. For example, if the number of increments in a financial year is one, then the increment interval should be 12 months. If the number of increments is two then the increment interval will be six months.

**This field is dependent on the number of increments**

Increment Percentage:

Universities/HEIs can set increment percentages according to the Government rules as well as their own, for their employees.

Pay band Categories

The University consists of pay band categories for its employees. It lists all the available categories of pay bands along with their descriptions.

Some pay band category already exists in the system by default, namely:

5200-20200

9300-34800

15600-39100

37400-67000

67000-79000

75500-80000

Steps to Add Pay Band Category:

- Click on the Pay Band Categories button provided on the top right-hand side.

- Admin can update/view the details.

- Click on Add Pay Band Categories and fill in the following information to create a new Pay Band Category:

- Pay Band Name

- Description

- Status (Active/In-Active).

- Click on the Save button.

Grade Pay Scale

The Grade Pay scale depends upon pay band categories. It is a term used in the 6th Pay Commission which defines the pay structure. The higher the rank, the more will be the grade pay.

Steps to add Grade Pay Scale:

- Click on the Grade Pay Scale button provided on the top right-hand side

- Admin can update/view the details.

- Click Add Grade PayScale to create a new Grade Pay Scale and fill in the required information details:

- Pay Band

- Grade Pay Name

- Grade Pay Amount

- Description

- Status (Active/In-Active)

- Click on the Save button

Levels

In the 7th Pay Commission, Pay Band and Pay Scale are merged into levels.

There are different levels ranging from 1 to 18 (According to academic and Non-academic).

Steps to add Level:

- Click on the Add Level button provided on the top right-hand side.

- Admin can update/view the details.

- Click the Add Level option and fill in the required information to a new level in the section:

- Level Name

- Pay Range (According to Paymetrix index/cell)

- Pay Band

- Description

- Status (Active/In-Active)

- Click on the Save button.

Note: If you select pay commission to be 6th pay commission then you will see two options of Pay band and Grade Pay which are used to make salary on 6th pay commission. If you select the 7th pay commission then you see the only matric required i.e. LEVEL.

Pay Matrix

In the Pay Matrix section, the admin needs to define the Pay Matrix that is present in the salary structure defined for the Central government employees. The pay structure is segregated into 18 different pay levels. University/Institution will add a Pay matrix according to the institution’s rules.

There are different levels ranging from 1 to 18 (According to academic and Non-academic).

Step to add Pay Matrix:

- Click on the Add Pay Matrix button on the top right-hand side of the screen.

- Admin can view/update the details

- Click the Add Pay Matrix option and fill the required details to add a new pay matrix in the section:

- Pay Matrix Name

- Pay Band

- Grade Pay

- Level (1 to 18)

- Cell No (1 to 40)

- Basic Pay

- Description

- Status (Active/Inactive)

- Click on the Save Button

Income Tax Sections

All sections are already added according to Government rules.

- Admin can only view the Income Tax section.

Income Tax Slabs

All Tax slabs (New slab and Old Slab) are already added as per Government Rules.

- Admin can only view the Income Tax Slabs.

Payroll Constants

In this option, some new income tax constants can be defined for the New Slab and Old slab according to the Government policies.

Income Tax Surcharge Slabs

In this option, some new income tax surcharge slabs can be defined for the New Slab and Old slab according to the Government policies.

Payroll Entry Types

Payroll entry type was designed to capture the types of payroll entries which are usually either Earnings or Deduction.

- Admin can view the Earning and Deductions.

Payroll Entry Groups

This subsection helps to add the various entry groups of earnings and deductions.

Steps to Add Entry Group:

- Click on the Payroll Entry Group button provided on the top right-hand side.

- Admin can View/Update entry details.

- Click Add Entry Group to add a new entry group and fill in the following information:

- Entry Type

- Name

- Short Code

- Description

- Status (Active/In-Active)

- Click on the Save button

Payroll Entries

This section captures the payroll entries for each type of payroll head. The admin can add and update salary component heads as needed.

Steps to add payroll entries:

- Click on the Payroll Entries button provided on the top right-hand side.

- Admin can View/Update Payroll Entries' details.

- Click Add Payroll Entry and fill in the following information to add a new Payroll Entry:

- Entry Type

- Entry Group

- Tax Group

- Report Group

- Entry Name

- Description

- Applicable On

- IT Section

- Maximum Limit (For IT Declaration Use)

- Display Order (For IT Declaration Use.)

- Status (Active/In-Active)

- Click on the Save button

Salary Structure Templates

Payroll_admin can add various salary structure templates with this option.

Steps to add Salary Structure Template:

- Click on the Salary Structure Template button provided on the top right-hand side.

- Admin can View/Update Salary Structure Template

- Click Add Salary Structure Template and fill the following details to add new Salary Structure Template:

- Nature of Employment (Permanent/Contract)

- Cadre (Teaching/Non-teaching)

- Salary Structure Template Name

- Pay Commission ID

- Level

- Status (Active/In-Active)

- Click on the Save button

After completing these steps admin can configure the employee salary structure (Earning rules and Deduction rules which are formula-wise and actual value also) that is reflected in the configured Employee salary slips.

(Non-practicing Allowance) or NPA: Non-Practicing Allowance is a special kind of allowance payable to Doctors occupying the posts of Medical and Veterinary Services.

System Wide Changes

If the payroll_admin wants to make some changes in the payroll entry, it can be done from this section, which will be reflected in the whole system.

- Admin can edit/update/Overview change into System/View Old Changes in the system icons available on the right side.

Group Management

Payroll_admin can create various Employee payroll groups from this section. Admin can create groups based on designation, nature of employment, type of employee, department wise etc. as per the requirement and assign accordingly.

Steps to create a group in Group Management:

- Click on the gear button in front of the Group Management.

- Click on the Create Groups button and fill in the required details i.e. Name and Description.

- Click on the Save button

Employee Group Management

The Employee Group Management section allows the admin to create and edit payroll groups. Admin can also add/remove employees from the group.

Here, the admin can create some groups based on designation, nature of employment, Cadre, etc. as per the requirement.

Edit: edit the group details by clicking on the Edit Group button.

Add: Create a Group by clicking on the Create a group button.

Overview: The admin can have an overview of all the groups, their member counts, and a list of members by clicking on the Overview button.

View: Admin can view all the member lists with names by clicking on the View icon.

Add/Remove Member: Admin can add/remove members from the groups as per the requirement by clicking on the Add/Remove Members button.

Add Group: Admin can add a new payroll management group by clicking on the Add Manage payroll management group button.

Note: In our module, we have one Payroll Dealing Assistant (PDA - who will generate salary) and one Payroll Change Manager (PCM - who will change the attributes related to payroll) for each Payroll Group (Single) which contains multiple Employee groups. These employee groups may contain single or multiple employees.

Admin can assign group assistant, and group manager (group-wise) in the managed payroll management group section.

Declaration

In this section, the admin can View/Edit the declaration which is reflected in pay slips during tax declaration in both Hindi & English languages.

Bulk Upload Management

In this section, all the Bulk upload sheets are available for Payroll Bulk Upload.

- Bulk Salary Configuration Data: The admin can upload Payroll salary configuration data in bulk in the portal he/she does not need to upload salary data one by one. i.e. Account Number, IFS Code, Basic Salary, PFMS number, etc.

- Bulk Salary Data: Here, the admin can upload all the earning head, deduction head, Gross, Net, and basic details in the portal after uploading whole details will be visible in the portal.

- Bulk Progression Data: In this section, the admin can upload/update basic salary in bulk by only mentioning employee code and basic salary details in the sheet uploaded in the portal. For this, the admin can upload/update the basic salary in bulk.

- Bulk Recurring Data: in this section, the admin can upload Recurring data by mentioning a particular head for a particular time period i.e. LIC by mentioning the start date and end date by mentioning a particular time being that head will In-active.

- Bulk One-Time Data: Here, the admin can upload bulk one-time data of employees by mentioning the Employee code, any salary head, selecting a particular month for that month admin required head (Arrear head, Recoveries head), the actual value. After filling all these details, admin can upload sheet that will be reflected for that particular month after which, it will be automatically de-activated.

- Bulk City Category Configuration Data: In this section admin can upload/update city-wise configuration data in bulk.

- Bulk Update Recurring Data: The admin can change/update any salary head status (active/inactive) and extend the salary head start date to the end date in the Bulk.

- Bulk Update Salary Configuration Field Data: Here, the admin can update any payroll Configuration details in the Bulk i.e Account Number, IFS Code, Basic Salary, PFMS number, etc.

- Bulk Arrear Data: Admin can upload NPS Arrear (Employee contribution and Employer contribution) in bulk here.

- Bulk Paymatrix Cell Data: Here, admin can upload Employee pay matrix cell in bulk.

- Bulk PF Contribution Data: Admin can upload NPS/CPF/NPS Arrear (Employee contribution and Employer contribution) in bulk after approving the salaries.

Head missing Listing

With this option, the admin can create and add various Major/Recurring Head Entry.

Steps to add Major/Recurring Head Entry:

- Click on the gear button in front of the Major/Recurring Head Entry section.

- Admin can View/Update Heads.

- Click the Add Head button to add a new head entry and fill in the following details:

- Head Type

- Entry Type

- Head Name

- Description

- Status

- Click on the Save button.

Feature Settings

This section displays the following features:

Allow/Not-allowed if required to be applicable in the payslips and reports section by the Payroll admin.

The admin can activate/de-activate to show PF Employer Contribution or Pay-Band on Salary Slip.

Admin can also send Pay slip-on Mail by activating the Send Salary Slip-on Mail button.

Admin can activate automatic Income Tax Calculation by clicking on the given button, the Tax will be automatically calculated and visible on the Salary slip.

Payroll Generation Date Setting

This feature is used for Payroll Generation for a set period (required to specify start date and end date). If the finance section has to generate salary for a particular month, the Admin needs to set a start and end date period and set it as Active. The HR/Establishment section cannot update the employee profile in the duration date.

Payroll PF Subscriptions

In this section, the Payroll admin can add various PF subscriptions that are applicable to the University/HEI like:

- General Provident Fund (GPF)

- Central Provident Fund (CPF)

- National Pension Scheme (NPS)

- Employees' Provident Funds (EPF) etc.

If a University/Institution has another PF subscription, they will add it by clicking on the Add on Subscription button, and filling in the required details.

Other Payment Listing

- In settings, a feature is added (Other Payment Listing), from where you can add heads for other payments separately.

- Only these heads will be shown in the drop-down while entering other payment data of employees individually.

- While uploading other payments of employees in bulk through an Excel sheet, they can only upload the values of the heads mapped in Other Payment Listing in the settings section.

When you click on the Settings button on the right side, a page with a grid view will open, where all the heads that are added by the admin / you for other payments will be shown.

When the payroll admin / You click on the Add Other payment Head button in the top right corner, a form view will open where the admin/ You can add a new head for other payments by clicking on the Save button.

After saving, the admin/ you can view or update. When he clicks on the three dots button on the right side, there will be two options from where the section can be viewed or updated.

Long-Term Advances Head

In this section, the Admin can add the long-term advance heads by clicking on the right side of the Add Long-term Advance Head button. Fill in the required details:

- Head Name - (That is reflected in the Payroll entries)

- Interest Head - (Yes/No)

- Description (this is not mandatory but can be filled in as per University/HEI requirement)

- Taxable? - (Yes/No)

- Visible (For IT Declaration Use.) - (Yes/No)

- Status - (Active/Inactive)

Once saved, the admin/ you can view or update. Click on the three dots button on the right side to get two options to view or update the section.

Loan Term Advances

In this section, the admin can add and configure the Long Term Advance category and rules which is applicable in the Institutions. The admin can create long-term advance heads and rules by clicking on the Add Long Term Advances/Loan button and fill the required fields:

- Name (In shortcode)

- Code (Heads code)

- Category (Advance/Loan)

- Description (this is not mandatory but can be filled in as per University/HEIs requirement)

- Status (Active/In-active)

After saving, the admin/ you can view or update. When he clicks on the three dots button on the right side he will get three options to view, update or update rules.

After clicking on the Update rule section, the admin can set the Loan/Advance interest rule (Interest deduction and principal deduction) for a particular head.

Report Template

In this section, the Payroll admin can design the Salary slips according to the Permanent/contractual with the University/Institution logo and require the Employee details in the Payslips.

With this option, the admin can create and add various Major/Recurring Head Entry.

Steps to add Major/Recurring Head Entry:

- Click on the gear button in front of the Major/Recurring Head Entry section.

- Admin can View/Update Heads.

- Click the Add Head button to add a new head entry and fill in the following details:

- Head Type

- Entry Type

- Head Name

- Description

- Status

- Click on the Save button.

Configuring employee Payroll and other information

The salary processing module manages the calculation of salaries of the employees based on their level or pay grade criteria.

All Employee

All employees are fetched from the employee management module. Here, payroll is configured for all these employees. This section shows 4 payroll filters/statuses with counts:

Payroll Active (contains a list of all employees whose payrolls are configured)

- When Admin defines salary structure for the employee and configures payroll for the employee, it automatically appears in the Payroll Active section as their status is changed from “Not Configured" to “Active”.

Flagged/Debarred (contains a list of employees who are marked debarred or whose payroll-related profile has been changed).

- Changed Value - By clicking on the I icon, one can view all the details if changed.

- If Payroll is active for a particular employee but some changes have been made which can affect the salary processing and generating mechanism, then entry for a particular employee automatically appears in the Flagged/Debarred section.

- To transfer the entry from flagged to the payroll active section, the admin needs to activate that entry by changing the status to Active again. Also, Employee Payroll status can be explicitly marked as debarred by the organization due to certain cases.

Payroll Not configured (contains a list of all those employees whose payroll is not configured yet)

- Salary not structured - This column specifies whether the particular employee salary structure is defined or not. When the salary structure is not defined then the cross icon appears, and the check icon appears.

Retired - After the date of superannuation/retirement is over, the portal automatically moves to the Retired section.

Employee Salary Structure

Here the employee is mapped with Payroll entries like which type of salary heads will be included for that employee. In this section, the admin can view/add/edit payroll entries for each employee individually. Admin can even add one-time payroll entries.

Add Payroll Entry: Payroll entry can be added by clicking on either the Add Payroll Entry button(Manually) or Add Payroll Entry from the Rules Set button (select from the already defined rules set).

Add Payroll one-time Entries: Admin can even add one-time payroll entries.

Admin/Dealing assistant can upload the salary slips through the Upload Bulk recurring sheet and Upload Bulk One Time Datasheet in the portal rules.

If the Admin/PD (Payroll Dealing Assistant) wants to add/deduct some amount to/from the employees, then it can be done in bulk under that salary head. For example: to provide bonuses, we can select multiple employees together and update that bonus amount.

Note: Payroll entry must be mapped to Employee Salary Structure for the bulk updates.

Generating Salary

Before processing and approving the salary, we need to generate it first. By clicking this option, the user is directed to the Employee Detail Records interface where information on all the employees of the payroll active section is displayed.

- Generate Individual Salary

If the Admin/PD (Payroll Dealing Assistant) wants to generate a salary for each employee one by one he/she can click on the Rupee icon.

Additionally - Admin/PD (Payroll Dealing Assistant) also process the employee salary as per the number of working days to follow the mentioned step:

- Click on the ‘Generate Salary’ Tab.

- Click on the ‘Add/Update’ button of the employee for whom you want to generate the salary based on the number of working days, and then the form will open.

- After filling in all the details, click on the ‘Final Submit’ button.

- You will get a flash message in the same tab.

- Now the process is completed and you can generate salary for this particular employee.

Generate Bulk Salary

If the Admin/PDA(Payroll Dealing Assistant) wants to generate employee salaries in bulk, the process is done by selecting all the employees whose salary needs to be generated together and clicking on the Generate Bulk Salary button.

If the Admin/PDA(Payroll Dealing Assistant) wants to generate a salary for a single employee then they search for the particular employee, click on the Rupee button and fill in the required details.

Process Salaries

After the salary is generated by the Admin/PDA (Payroll Dealing Assistant), it is moved to the Process Salary section.

View Generated Salary

After the salary is generated by the Admin/PDA (Payroll Dealing Assistant), the salary slip can be viewed after Generation/approval salary slips, by clicking on the View icon.

View Previous Salary

After the salary is generated, the Admin/PDA (Payroll Dealing Assistant) can also view the previous salary slip of an employee by clicking on the View icon. It can also be printed from here as per the requirement.

- Delete Bulk Salary

If there is a need to delete a salary entry for any changes, the Admin/PDA (Payroll Dealing Assistant) needs to click on the delete Bulk Salary button. After deleting, the generated salaries, the Admin/PDA (Payroll Dealing Assistant) can regenerate the employee salary multiple times.

- Verify Individual/Bulk Salary

Upon clicking this option, the PVO (Payroll Verification Officer)/Admin is directed to the Salary Processing Interface of all the employees whose salary has been generated.

The information displayed on this page is only of those employees whose salary has been generated. The PVO(Payroll Verification Officer)/Admin can l verify the salary details and mark it as verified by clicking on the Verify Bulk Salary button.

- Un-Verify Individually/Bulk Salary

If Admin/PVO (Payroll Verification Officer) wants to un-verify the salary which has been verified but not finalized yet due to some changes, then he/she needs to click on the un-verify Bulk Salary button. It cannot be unprocessed/unverified once finalized. Un-verification can be done for multiple employees in bulk.

- Finalize Bulk Salary

After verification, the PVO (Payroll Verification Officer)/Admin can finalize the salary for approval. No changes can be incorporated after the finalization process.

- Approve Bulk Salary

Upon clicking this option, the AR(Assistant Registrar)/Admin is directed to the Salary Processing Interface of all the employees whose salary has been processed.

The information displayed on this page is only for those employees whose salary has been verified and finalized.

- Download Generated salary option

After generating the salary, Admin/PDA (Payroll Dealing Assistant) can generate a Pre-procession reports (Excel/PDF) report by clicking on the Download Generate Salary button.

Approved Salaries

Admin can view the approved employee salary details for information.

Provident Fund Contributions

Admin can view the Provident fund employee/employer contributions details for just information to each employee. Admin can select the filtration for our according information.

Income Tax Section

When the user clicks on this option, they are redirected to the Income Tax Management Interface. This interface allows the user to manage/deposit and generate slips for payments of income tax returns for each employee.

- Income tax Depositions

When the user clicks on the tax deposition, the control is redirected to the tax deposition entries. This interface allows the user to add new tax depositions.

Add Tax Deposit: Admin can add Tax Deposit by clicking on Add Tax Deposit and filling in the required details.

- Income Tax Generation & Declaration

To generate an Income tax declaration, click on the Show List icon then select the year and click on submit.

After calculating all the Gross earnings, Gross Deduction, and Net Pay; the admin can declare tax by saving the changes.

Admin can also generate Income Tax Declaration details in Excel format.

- Form 24

In this section, Admin can generate the IT form 24 in the Excel format to select the Financial year for verification of the Income Tax declaration details.

- Income Tax Projection

In this section, Admin can generate the Income Tax projection report in Excel format as per Financial year.

Removed Salary Logs

In this section, the admin can view deleted salary details that were removed after salary approval.

FSCM Mapping

This section links the Payroll module with the FSCM and Vendor Bill modules. After approval, the salary admin can process salary bills and allocate deductions under liabilities and income heads in the FSCM module.

Prerequisites for Creating Salary Bills:

- Ensure a bill type PAYROLL BILL with the category VENDOR BILL is available (system-generated). If not, create it as specified.

- Create a vendor named PAYROLL VENDOR in the vendor section of the FSCM module, completing all required fields.

Here are some of the steps for processing the salary bills through the Payroll module.

Payment Scheme

In this his section, a feature called “FSCM & Salary Head Mapping Configuration” is added, allowing you to integrate FSCM (Budget) with Payroll. You can also find this settings section in the left-side menu bar.

When you click on it, a page with a grid view will open, displaying all the mappings (Configurations).

The first step here should be creating the configuration. For this click on the Create Scheme button. When you click on it, a form will open.

Create the configuration according to the needs of the institute, and fill the require details:

- Name (Add the configuration name according to the Institution)

- Financial Year (like; 2024-2025)

- Type (Group/other)

- Groups (Select the group name)

- Employees (select employee accordingly)

- Description (Mentione according to the Institution)

After creating the combination click on the Map Heads button, and the following page will open:

By clicking on the View Scheme Details button, you can see all the details based on the configuration.

Before this Mapping, you should follow the following rules (Disclaimer):

- Select only that source OU (Organization Unit), for which the Budget Estimate has been done in FSCM Module while mapping net salary head.

- Source details (OU, Category, Head & Subhead) should be the same for all the mapping throughout this configuration.

- While adding the source details, the source budget subhead should be selected if it exists based on the selected source budget head.

- After mapping salary deduction heads, source details of net salary head can not be changed.

- All salary deduction heads (Deduction heads included in gross salary deductions) should be mapped for this configuration.

If there is a source subhead based on the selected source head (Estimate is created based on the sub head) then you should select that subhead while mapping Net Salary Head.

Now, click on the Add/Update button beside Salary Deduction Heads Mapping to map deduction heads with the budget.

After mapping all the salary deduction heads with Source & destination budget details, click on the save button.

Now, click on the Add button beside Employer Contribution Heads Mapping to map employer contribution heads with the budget.

If all the details are correct, click on the check box and then click on the to ‘Publish’ button to publish this configuration.

To map a new salary deduction head with this configuration, you have to unpublish the configuration. Then, map the deduction head, and finally publish this configuration again.

Generate Salary Bill

Before generating a salary bill, you should follow the following rules (Disclaimer):

- Bill will be generated based on the configuration that you have created in Payment Scheme.

- Configuration should be published.

- Salary should be approved for the specific Financial Year, Year, and Month before generating the salary bill.

- If you are trying to generate a salary bill for the same configuration (Same Financial Year, Year & month), the previous bill (Deduction Heads) with this configuration should be parked.

After filling in all the details, when you click on the Submit button, a page displaying all the details (Bill Amount, Source Budget Details) will open.

If the salary bill amount is greater than the available balance based on the source details, then the bill will not be generated.

If all the details are correct, click on the Generate Bill button to generate the salary bill.

After generating the salary bill you can view all the details in the Bill & Deduction Details Tab.

Manage Salary Deductions

Before parking salary deduction heads, you should follow the following rules (Disclaimer).

- Generated bill should be approved based on the approval hierarchy in the Vendor Bill Tracking module.

- If the bill is approved, then the configurations corresponding to the Financial Year, Year, & Month will be displayed in the Configuration dropdown.

- All the salary deduction heads (*Deduction heads included in gross salary deductions) should be mapped with the configurations.

After filling in all the details, when you click on the Submit button, a page displaying all the details (Approved Salary Bill Details, Parking details of Individual salary deduction heads) will open.

If there is any mismatch between the amount to be parked and the total deduction amount, then you can not park the deduction heads. You have to map the remaining salary deduction heads in FSCM & Salary Head Mapping Configuration Settings that are used in Gross salary deductions.

If all the details are correct, Click on the Park button to park all the salary deduction heads.

After parking the salary deduction heads, you can view all the details in the Bill & Deduction Details Tab.

Bill & Deduction Details

In this section, the admin can view the parked net and deduction details after parking the salary deduction.

Advances/Loan

Loan Request

Admin click on Loan Request section then the page opens where all loans and advances that are applied and viewed. There is a button, Add Loan Request to add loan requests. Click on that button. When you click on the Add Loan Request form opens to add a request. The field that has * in Label are required fields, or these Fields are mandatory.

- View page

When you submit this form, you will be redirected to the View page where you can see all the information about the Advance or Loan that you created. And the admin APPROVE OR REJECT THE FORM FROM the View page, the installment deduction date is automatically generated by the system.

When you approve the head map automatically, and form the starting date of the installment deduction, the deduction or recovery will start and redirect to the Loans page, where all Approved loans and complete loan lists will be displayed.

Loans

The Loans section, where all approved loans and complete loan lists will be displayed.

- View Loan

To view loan details, click on the view detail button, after that loan details view will be displayed.

Other Taxable Payment

Here admin can uplaod and map the another then salary details, like; Honorarium, Child Education Allowans etc.

Entries

In the Entries section, the Admin can add other payment head details for a smooth upload. By clicking the Other Payment Listing button (top right corner), institutions can add salary details paid to employees individually or in bulk via an Excel sheet.

- Other Payment Bulk Upload

When the Payroll Admin clicks the Upload Bulk Other Payment Data button (top right), a modal appears, providing key details on bulk uploading other payments through Excel. It includes data type requirements (Integer, String), mandatory fields, and necessary entry guidelines.

- Other Payment Single Entry

When the Admin clicks the Entry button, a view page opens displaying the selected employee’s details for generating other payments.

- Adding a Single Other Payment Entry: Click the Add Single Other Payment Entry button to open a modal. Enter the required details and click Save.

If an entry already exists for the same Employee Code, Other Payment Head, Financial Year, Year, Month, and Diary No, an error message appears: “Other Payment Entry Already Generated For This Diary No [Diary No].”

If the entry is new, it is saved successfully, and a success message appears: “Other Payment Entry Generated Successfully For This Employee.”

The system redirects to the previous page after submission.

- Viewing and Managing Entries: Successfully generated other payments appear in a grid below the Add Single Other Payment Entry button. If the payment is still in the generated stage, the Admin can update or delete the entry as needed.

Process

When the Admin clicks the Process section in the left-side menu bar, all Other Payments in the Generated stage are displayed in a grid view.

- Actions in the Process Section:

Verify Other Payments: Admin can verify payments individually or in bulk. Once verified, payments move from the Generated stage to the Verified section.

Delete Other Payments: Admin can delete payments individually or in bulk. Once deleted, the data is removed from the Generated section.

Un-verify Other Payments: Admin can un-verify payments individually or in bulk. Once unverified, payments return from the Verified section to the Generated stage.

Finalize Other Payments: Admin can finalize payments individually or in bulk. Once finalized, payments move from the Verified stage to the Finalized section.

Approve Other Payments: Admin can approve payments individually or in bulk. Once approved, payments move from the Finalized stage to the Approved section.

Approved List

When the Admin clicks on the Approved List section in the left-side menu bar, all Other Payments that have reached the Approved stage will be displayed in a grid view.

This section provides a final overview of all approved payments, ensuring transparency and easy tracking.

Removed logs

In this section, the Admin can view details that have been removed from the system, excluding salary details, after approval.

- Key Features:

Tracks removed non-salary-related entries post-approval.

Provides transparency on data modifications and deletions.

Helps in auditing and maintaining data integrity.

This section ensures that all removals are properly logged and monitored.

Arrear Process

Arrear Type

In this section, the admin must first define the Arrear type.

- Steps to Define Arrear Type:

Navigate to the Arrear Section.

Click on the “Add Arrear Type” button to create a new arrear type.

Fill in the required details in the form.

Click on the “Save” button to store the entry.

- Editing & Logs: If no Arrear Configuration has been created, you can update the arrear type details.

Changes made can be tracked in the History section under the Action column.

Restrictions: Once an Arrear Configuration is created based on a specific arrear type, the Arrear Type cannot be updated.

This ensures data consistency and prevents unauthorized modifications.

Arrear Configuration

- Steps to Create Arrear Configuration:

Click on the “Add Configuration” button.

Fill in the required details in the form.

Click on the “Save” button to store the entry.

- Validation Checks:

Unique Name: Each arrear configuration must have a unique name.

Duplicate Data Prevention: The same arrear data cannot be entered twice for the same employee within the same date range.

- Date Validation:

The “To Date” must be greater than the “From Date”.

While configuring an arrear head, the “From Date” & “To Date” must not overlap with the date range of any existing arrear entries for the same arrear head.

Once the configuration is successfully created, arrears will be generated based on this setup.

Generate Arrear

- Steps to Generate Arrear:

Select the Configuration from the dropdown menu.

Click on the “Submit” button.

The arrear will be generated based on the selected configuration.

After submission, the system will redirect to the “Process” tab, where the generated arrears can be reviewed and further processed.

Process Arrear

- Steps to Process Arrear:

Select the Configuration from the dropdown menu in the Process section.

Click on the “Submit” button.

The arrear will be generated based on the selected configuration.

The system will redirect to the “Process” tab, where the admin can review the generated arrears.

Verification & Approval Process:

Admin can verify increments individually or in bulk.

Verified arrears move to the Verified section.

Admin can un-verify increments, which moves them back to the Generated section.

After verification, arrears can be finalized and moved to the Finalized section.

Once finalized, arrears can be approved, shifting them to the Approved section.

Once approved, arrears are ready for salary processing and report generation.

🔹 Note: Ensure all details are checked before proceeding to the next step.

Arrear Payment

Steps to Process Arrear Payment:

Select the Payment Type:

With Salary: The arrear amount will be added as a one-time entry for the selected employee.

Without Salary (Bill): A bill will be generated for the employee in the Bill Tracking Module.

Click on the Submit button to proceed.

System Actions:

If the payment type is With Salary, the arrear amount is automatically included in the employee’s next salary cycle.

If the payment type is Without Salary, the system will generate a bill entry in the Bill Tracking Module, where it can be processed separately.

🔹 Note: Ensure the correct payment type is selected before submission, as changes may not be allowed once processed.

Arrears Paid with Salary

In this section, the admin can view all the arrears that have been paid along with the salary.

🔹 Note: This tab helps in tracking arrears that have been successfully processed as part of the employee’s salary.

Arrear Paid through Bill

In this section, the admin can view all the arrears that have been paid separately through the bill.

🔹 Note: This tab helps in tracking arrears that have been processed as independent payments through the Bill Tracking Module.

Removed/Reversed Arrear bill

In this section, the admin can view all the arrear bills that have been reversed or marked as inactive.

🔹 Note: This tab helps in tracking arrears that were either canceled or deactivated for any reason.

Increment

Before processing increments, universities/HEIs must ensure that the following employee details are accurately entered:

- Pay Band – Define the employee’s pay structure.

- Level ID – Assign the appropriate level as per the pay matrix.

- Pay Matrix Cell – Specify the correct pay cell within the assigned level.

- Date of Next Increment – Set the increment date based on the employee’s eligibility.

These details are crucial for the automatic calculation and processing of increments within the system.

- Pay Matrix (Settings)

Before running the Increment Process, the Payroll Admin must verify and update the Pay Matrix under the Payroll Settings section.

It is important because, When an employee’s Basic Salary is incremented, the system validates the new salary amount using the Pay Matrix Data Table. The system checks if the new Basic Salary, Level ID, and Cell ID combination exists in the Pay Matrix. If this combination is not found, the increment will not be applied to that employee.

If the combination does not exist in the pay matrix table then the increment for that employee will not happen.

- Financial Cycle (Settings)

The Financial Cycle Setting in the Settings section now includes the following new fields:

- No. of Increments:

Universities can specify how many increments an employee will receive in a Financial Year.

They can choose to grant increments once, twice, or even thrice, depending on their policies.

Defines the gap between two increments in months. It is dependent on the No. of Increments field.

Example:

If No. of Increments = 1, then Increment Interval = 12 months (i.e., yearly).

If No. of Increments = 2, then Increment Interval = 6 months (i.e., biannual).

- Increment Percentage:

Universities can set increment percentages based on government rules or their own internal policies for employees. This flexibility allows institutions to define salary increments as per their financial planning and regulatory requirements.

Generate

When the Payroll Admin clicks on the Generate section in the left-side menu bar of the Payroll module, a form will appear.

- Form Submission: The admin fills in the required details (Financial Year, Month). Clicks on the Submit button.

A grid view will display all employees whose Payroll Status & Salary Configuration Status are active and whose increment is due in the selected financial year and month.

- Generating Increments: Users with the necessary permissions can access this page.

Single Increment Generation: Click the Generate button next to an employee’s name.

Bulk Increment Generation: Select multiple employees using checkboxes and click the Generate Bulk button.

Process

When the Payroll Admin clicks on the Process section in the left-side menu bar, all increments in the Generated stage will be displayed in a grid view.

Actions Available in the Process Section:

Verify Increments: The admin/you can verify increments individually or in bulk. Verified increments will move to the Verified section.

Delete Increments: The admin/you can delete increments individually or in bulk. Deleted increments will be removed from the database and no longer appear in the Generated section.

Un-Verify Increments: The admin/you can un-verify increments individually or in bulk. Un-verified increments will return to the Generated section.

Finalize Increments: The admin/you can finalize increments individually or in bulk. Finalized increments will move to the Finalized section.

Approve Increments: The admin/you can approve increments individually or in bulk. Approved increments will move to the Approved section.

Additional Details: Flash Messages: Every action (verification, deletion, un-verification, finalization, approval) will be confirmed with a flash message for user feedback.

Approved List

When the Payroll Admin clicks on the Approved List section in the left-side menu bar, all increments in the Approved stage will be displayed in a grid view.

Key Features: Displays only increments that have reached the Approved stage.

Provides a clear overview of all approved increments.

Ensures that only verified and finalized increments are shown.

This section allows the admin to track and review approved increments for payroll processing.

Other Section

PFMS Report

Once salaries have reached the Approved stage, users with Admin/PDA roles can download PFMS reports in Excel format.

- Key Features:

Accessible Only After Approval: The option to download appears once salaries are approved.

Excel Format: Ensures compatibility with financial systems and reporting tools.

This feature ensures smooth payroll processing and compliance with financial reporting standards.

Treasury Report

Once salaries have reached the Approved stage, users with Admin/PDA roles can download JSON reports in Text format.

- Key Features:

Accessible Only After Approval: The download option appears once salaries are approved.

Text Format: The JSON data is structured in a text file for easy processing and integration.

This feature ensures seamless data integration with financial and payroll systems.

Bulk Upload Logs

In this section, the Admin can view all logs of unloaded Excel details related to bulk uploads.

- Key Features:

Displays a complete log of unloaded Excel files.

Helps track any upload failures or missing data.

Allows admins to review and troubleshoot bulk uploads efficiently.

This section ensures transparency and accuracy in the bulk upload process.

Download Status

In this section, users with Admin/PDA roles can securely download reports (such as PFMS and JSON reports) only after entering a secure password.

- Key Features:

Password Protection: Users must enter a password before downloading reports.

Secure Access: Only authorized users with Admin/PDA roles can proceed.

Report Formats: Available in Excel (PFMS) and Text (JSON) formats.

Enhanced Data Security: Prevents unauthorized access to payroll data.

This ensures that sensitive payroll information remains secure while allowing authorized users to retrieve essential reports.

Payroll Reports

In this report section, Admin (all requested payroll roles) can download the payroll reports.

Pay Slip Report

Admin has an option to generate bulk salary slips for all employees and print them in PDF format by clicking on the Print PDF button.

Admin can also click on the All employee salary slip through the mail/Official Email ID by clicking on the Compose mail button.

Single Sheet

It shows the list of all the employees with their pay level, department, Designation, and basic pay along with all the deductions and savings. The Employee single sheet will display the employee’s savings and Income Tax projection (according to the Old slab and New slab).

Department Summary Before Approval

It shows the overall earnings and deductions of the entire department before approval of salary.

Department Summary

It shows the overall earnings and deductions of the entire department after approval of salary.

Provident Fund Report

GPF/CPF: It is categorized by different employee categories and shows the amount of CPF/GPF subscriptions added for the particular month.

NPS: The National Pension System(NPS) is calculated and computed based on the employee’s basic pay with the salary head Dearness Allowance (DA).

Note: The amount of NPS calculated for Doctors also includes NPA.

Contingent Bill Report

Contingent bills are generated on the basis of extra expenses in the management of an office.

Remittance Letter

A remittance letter is issued to employees as payment towards some expenses made in the office or is sent as a gift to the employee.

Salary Head Report

Salary heads reports are generated with all salary heads details for a particular month and can be downloaded in Excel/PDF format.

Monthly Bank Advice Report

It will be generated for monthly salary purposes and institutions will be able to generate an Employee monthly bank statement after approved the salary for a particular month.

Check Bank Data Report Before Approval

It will be generated for monthly salary purposes and institutions will be able to generate an Employee monthly bank statement before approve the salary for a particular month.

Earning-Deduction Report

It will generate an Earning and Deduction Report of an employee for a particular month.

LIC Report

The LIC report generated here gives information about the employees who have opted for LIC policy.

Income Tax Deduction Statement

It will be generated here to give the Information about the Employee’s income tax deduction statement.

Last Pay Certificate

This is given to the employee who is going to be transferred from the existing organization or is on superannuation. It is very important for any employee because of its defined pay of employees or pension in the case of superannuation.

Employee Wise Approved Salary Report

It will provide financial year reports to a Particular Employee (From Date to Date).

Pre-Processing Report

Pre-Processing Report generates reports of those employees who have some missing details which can affect the salary generation process.

All details need to be completed before processing salaries so that they can be verified and finalized accordingly.

Export Approved Salary Report

It will provide an approved Excel report for the particular month and after the salary approval.

Monthly Salary Comparison Report

It will provide an Excel sheet for comparing Employee’s previous month’s salary details and the current month’s salary details for verification purposes.

Employee Wise Monthly Pay Report

This report is generated monthly for each employee and downloaded in PDF.

Pay Bill Employee Wise Report

This report generates monthly paybill information for each employee and shows a total summary of Paybill and can be downloaded in PDF format.

Pay Bill Department Wise Report

This report generates monthly paybill information for each employee department wise and shows a total summary of Paybill which can be downloaded in PDF format.

OU Wise Pay Report

This report is generated monthly for each Organizational Unit.

Employee Wise Head Report

This report has provided particular employees’ heads reports from date to end date accordingly.

Financial Year Report

This report has been generated for Financial year reports for each employee’s salary details.

Bulk Single Sheet Report

It shows the list of all the employees with their pay level, department, designation, and basic pay along with all the deductions and savings. The Employee single sheet shows all saving and Income Tax projection (according to Old slab and New slab). The Admin can generate all employee single sheet statements in bulk (PDF).

Other Payment Report

This report generates other taxable information for each employee month-wise after the upload in the portal in PDF/Excel format.

Financial Year Wise Other Payment Report

This report generates other taxable information for each and particular employee as per financial year after the approval in the portal and can be downloaded in PDF format.

Increment Report

This report generates increment information for each employee for process status as per financial year after the generated/approved status in the portal in PDF/Excel format.

Employee Wise PBR Report

This report generates a particular employee’s financial statement in the single format for financial wise in the portal in PDF/Excel format.

Salary Summary Report

This reports generates a total Earning and dedcution details statement for a particular month in PDF format.

Salary TDS Deduction Report

This reports generates Income Tax quarterly statement in the single format in PDF/Excel.

Other Payment TDS Deduction Report

This reports generates other payement Income Tax statement accoding to the from approved date to approved date in the single format in PDF/Excel.

Head View Wise Salary Head Report

This reports generates salary heads wise statement in the single PDF format.

Employee Wise All Month Report

This reports generates paid salary details statement for a particual financial year in the single Excel format.

Activity Logs

Here logs of any updates/changes made in the payroll module are recorded.

Administrator Guide for Employee User

Employee Guide for generating salary slips and declaring Income Tax through Payroll Management System.

Introduction

This User Guide will help employees check their salary details, download their salary slips using their login credentials, and declare their tax and investment details.

Employee Login

The employee needs to log in using their login ID and password.

After logging in, the employee will click on the Finance section in the menu.

Dashboard

The dashboard provides an overview of the employee’s finances like their recent payslips and payroll details.

Payroll Details

In this section, the Employee can view:

Salary Details The employee can view all details like name, department, designation, pay level, basic salary amount, PF account details, beneficiary name, date of birth etc.

Bank Details Employee can view salary account details like Bank name, account number, IFSC code, branch name etc.

Single Sheet Report

Employees can fetch/download single sheet reports in this section to view the approved salary and estimated salary details. The single sheet report shows the employee’s financial year overview to declare the Income tax form.

PBR Report

Employees can view PBR reports financial year-wise and can download these reports in PDF format by clicking on Print PDF.

Salary Slips

Employee can view the Salary Slip as per Financial Year by clicking on the View button and can download the Salary Slip in PDF format by clicking on Print PDF.

Income Tax

Employees can view their Estimated income tax details for the current financial year in the income tax section. This section helps declare the income tax form.

Declare Your Income Tax

The employee can view/add all Income tax declarations like Employee details, Other income, Permissible Deductions, and Tax Calculations.

After declaring the Income tax form, the Employee can download the declaration form in PDF format and submit it to the University/Institution finance department/section.

Other Payment Report

In this section, employees can check other details received apart from Salary (eg; Children’s Education Allowance, Honorarium etc.) as per Financial Year and can also download the details in PDF format by clicking on Print PDF.

Provident Fund

About

The Provident Fund module is designed to facilitate the efficient management of employee provident fund accounts in a University/HEI. It automates tasks related to contributions, withdrawals, interest calculations, and account maintenance for employees eligible under the GPF scheme.

Key Features of the Provident Fund Management (GPF) Module

- Employee Subscription Management: Tracks monthly contributions based on the percentage chosen by the employee.

- Loan and Withdrawal Processing: Handles advanced payments, withdrawals, and their recovery through payroll.

- Interest Calculation: Calculates yearly interest on the fund balance as per government-specified rates.

- Annual Statement Generation: Provides detailed statements of contributions, interest earned, withdrawals, and closing balances.

- Account Management: Maintains individual GPF account ledgers with historical data and current status.

- Integration with Payroll System: Syncs deductions and recoveries seamlessly with the payroll module.

Benefits of Provident Fund Management

- Ensures transparency and accuracy in fund management.

- Reduces manual work and potential errors.

- Facilitates easy access to employee fund information.

- Complies with government regulations and financial audits.

Prerequisites to initiate the Provident Fund Management module

To use the Provident Fund Management module smoothly, Universities/HEIs must complete the following steps in the Samarth Suite:

- Set up the Base Module with Organizational Units

- Create and define the structure of the university, like departments, sections, and centres.

- Create Admin and User Accounts

- Create administrative accounts for module administrators.

- Set up user accounts for employees to ensure access and functionality.

- Process GPF Subscription Salary

- Make sure the salary for GPF-subscribed employees is processed through the Payroll Management module.

Roles in the PF Process

- pf_admin: This administrative role should be assigned to an account responsible for configuring all settings in the Provident Fund module. The assigned user will have full access and authority to perform all actions within the module.

Administrator’s Guide (pf_admin)

Provident Fund Management Dashboard

The dashboard provides a summary view of the Provident Fund (GPF) details for all employees enrolled under the GPF scheme.

Configuration (Settings)

Payroll Financial Year

The PF Admin can set the duration of the payroll financial year in the settings. (This duration should be the same as the Payroll Financial Cycle Settings.)

Steps to add Payroll Financial Year:

- Click on the Add button provided on the top-right side to add the duration.

- After adding the detail, click on the Savebutton to confirm this entry if the entered data is correct.

Note: After confirmation, data cannot be deleted.

GPF Financial Year

PF Admin can add and set the duration of GPF financial year in the setting.

Steps to add GPF Financial Year:

- Click on the Add button provided on the top-right side to add the duration.

- After adding the detail, click on the Save button to confirm this entry if the entered data is correct.

After confirmation, data cannot be deleted.

Note: In case, GPF calculation is based on a financial year duration from April to March, payroll entry for March will be calculated in April, April will be calculated in May and so on. The payroll for February will be calculated in March.

When the financial year is from April to March, the payroll will be calculated for the month in itself: April to be calculated in April, May in May and so on.

GPF Interest Rate

The PF Admin set the GPF interest rate (Set by the Government) for each month based on the Financial Year.

- Click on the Add in Bulk button to add interest rates in bulk for each of the financial years set in the GPF financial year duration in settings.

GPF Heads & Payroll Head Mapping

The PF Admin can define and map GPF deduction heads used in the Payroll module.

For example:

If the Finance Section has deducted GPF Advance or Loan amounts under different heads and now wants those deductions to appear correctly in the GPF Statement Reports with the correct interest calculation, they can map those deduction heads here.

This ensures accurate reporting and interest calculation for GPF-related deductions.

Feature Settings

These settings will be applicable in the employee’s login.

- Admin can control the visibility of the GPF interest amount & closing balance in the GPF Statement in the employee’s login.

Declaration

The PF Admin can update and add the declaration for the GPF statement.

To edit the declaration for the GPF statement:

- Click on the three-dot button provided on the right side

- Then click on the Update button and update the declaration.

Configuring employee GPF and other information

Opening Balance

In this section, PF Admin can add and uplaod the employees GPF opening balance, these configuration will be cofigure and uplaod only one time.

Steps to add Opening Balance:

- Click on the Bulk Data button to upload the opening balance for each employee for a particular financial year in bulk.

- After uploading the opening balance, click if the data is correct and confirm the entry individually or in bulk.

Note: After confirmation, data cannot be deleted. And add the Opening balance for the month of April.

Manage GPF Monthly Data

In this section, the Admin can upload GPF head values for the month — including GPF Arrear, Withdrawal, Refund, and Advance — either individually or in bulk.

- If no data is uploaded for a particular month, the system will automatically consider the value as 0 for that head.

- The uploaded values are independent of the Payroll Financial Year when the year follows the March to February cycle.

Example:

Payroll Financial Year: March to February (2025–2026)

You want to generate the GPF statement for April 2025.

- This GPF statement will be based on March payroll entries.

- If any GPF values exist (Arrear, Withdrawal, Refund, Advance), you must upload them for April 2025.

- The statement generated will reflect the data entered for April 2025.

Important Note: Once confirmed, uploaded data cannot be deleted. Please review before submission.

Generate Statements

In this section, Admin can genrate the employee montly GPF statement.

To generate GPF statements:

- Fill in the required details and click the Submit button.

You can generate statements for a single employee or for multiple employees at once.

Example:

Case 1: Payroll Financial Year – March to February (2025–2026)

You want to generate the GPF statement for April 2025.

Then fill the form as follows:

- Financial Year: 2025–2026

- Year: 2025

- Month: March

After submission, the GPF statement for April 2025 will be generated.

Case 2: Payroll Financial Year – April to March (2025–2026)

You want to generate the GPF statement for April 2025.

Then fill the form as follows:

- Financial Year: 2025–2026

- Year: 2025

- Month: April

After submission, the GPF statement for April 2025 will be generated.

Process GPF Statements

In this section, the Admin can verify, finalize, and approve the GPF statements (either individually or in bulk) after generating the employee’s PF statement.

Note: If there is any error in the generated GPF statement, you can delete the entry (individually or in bulk) before approval. Once approved, changes cannot be made.

Approved Statements

This tab displays only the approved GPF statements separately for easy reference.

Reports

There are 5 reports available in the GPF module:

Month-Wise GPF Opening Balance

This report provides the details of the GPF opening balance on monthly basis.

To download the report:

- Click on the Generate Report button provided in front of the respective report.

- Fill in all the details that are required.

- Click on the Submit button

The report will be downloaded in Excel format.

Month-Wise GPF Heads Data

This report provides details of the GPF Heads data.

To download the report:

- Click on the Generate Report button provided in front of the respective report.

- Fill in all the details that are required.

- Click on the Submit button.

The report will be downloaded in Excel format.

Month-wise GPF Statement

This report provides details of the GPF Statement for the month.

To download the report:

- Click on the Generate Report button provided in front of the respective report.

- Fill in all the details that are required.

- Click on the Submit button.

The report will be downloaded in Excel format.

Financial Year Wise GPF Statement

This report provides details of the GPF Statement on a yearly basis.

To download the report:

- Click on the Generate Report button provided in front of the respective report.

- Fill in all the details that are required

- Click on the Submit button

The report will be downloaded in PDF format.

GPF Broad Sheet Report

This report provides details of the Broad Sheet Of GPF Account(Yearly basis).

To download the report:

- Click on the Generate Report button provided in front of the respective report.

- Fill in all the details that are required

- Click on the Submit button

The report will be downloaded in PDF format.